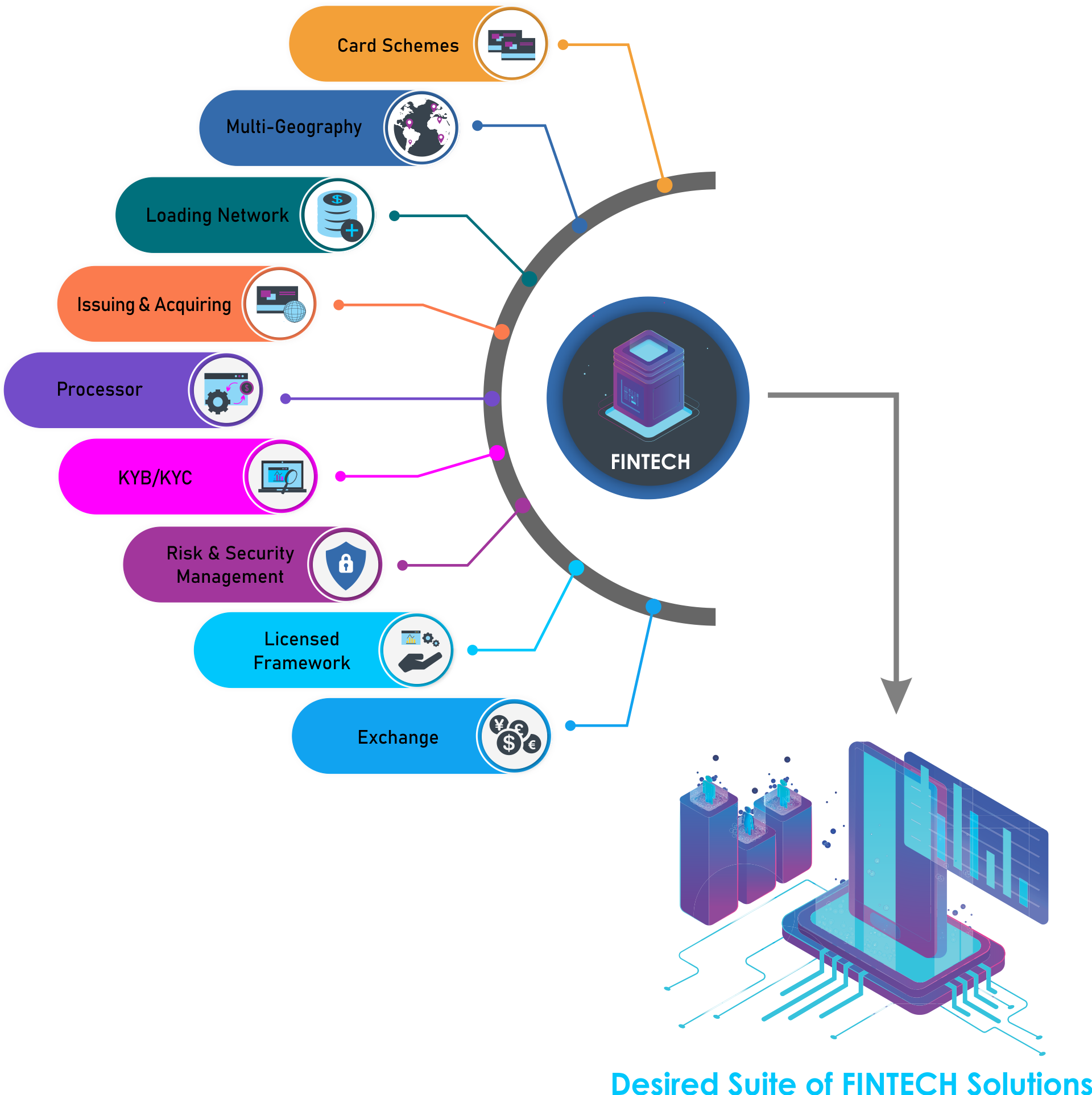

Global Network Ecosystem

Merchants encounter a variety of issues when seeking to secure and execute a multi-faceted international payment strategy by way of a “Desired Suite of Fintech Solutions”

There exists an incredibly complex legal and regulatory framework, requiring huge amounts of time and investment capital

Licensed and headquartered in SE Asia, VASU provides a superior and distinctive international nexus point of economic, geographic, demographic and operational advantages to worldwide merchant clientele. VASU is today reputationally positioned as a “provider of choice” for global businesses seeking a diversity of customized universal payment channels.

Numerous traditional financial institutions and many modern fintech companies lack experience in emerging markets and the ability to manage scaled customer onboarding and risk management to cover the entirety of the global marketplace

How does VASU do it?

VASU Licensed & Regulated FINTECH Holdings

Vasu International Payment Solutions Inc. (“VASU”), is the holder of an Operator of a Payment System (“OPS”) Registration in the Philippines, governed under the purview of the Bangko Sentral ng Pilipinas (the“BSP”)

VASU controlled (indirect), Vasu Australia PTY LTD, is the holder of an Electronic Funds Transfer, Foreign Exchange, and Digital Currency Exchange Service Provider license with AUSTRAC

VASU controlled (indirect), Lithuanian entity being holder of an Operator of a Depository Virtual Currency Wallet, and Virtual Currency Exchange Operator license with Regitru Centras Lithuania

Ownership of three (3) Payment Gateway(s) for credit/debit cards, APM’s and/or cryptocurrency transactions

API integration and operational tie-ups with hundreds of payment options globally – Credit/debit cards, crypto/NFT’s, e-wallets, bank accounts and e-payment vouchers

PCI Certified International/multi-currency prepaid card issuing platform; (VISA, MasterCard, China Union Pay) for both virtual and physical cards

eWallet/mWallet technology deployment capabilities, w/ SWIFT and IBAN account creation features

‘Banking as a Service’ – allows anyone in the world to open up a crypto-friendly bank account and buy/sell/ trade crypto

Strategic partnership(s) with regulated cryptocurrency licensed entities in the Philippines (buying, selling, asset management)

VASU offers specific global industry enterprises the option to white-label or co-brand all or part of the VASU ecosystem, from the entire platform to cards and NFC peripherals

‘Global Licensed OTC Services’ – subject to KYB/KYC allowing individuals and/or corporations to onboard to facilitate FIAT/Crypto transactions by way of our Canadian MSB licensed partner entity

*** Services and solutions offered through Vasu International Payment Solutions Inc., are subject to business approval, geographical availability, and regulatory authorization, and there is no guarantee that the product will become available in a specific timeframe, or to a specific customer group or geography. You should carefully conduct your own investigations and analyses in connection with any participation with the services and solutions, including your objectives, risk factors, fees, and expenses and the information set forth in these materials. All prospective users of the services and solutions described herein are advised to consult with their legal, accounting and tax advisers regarding any potential participation. Services and solutions are subject to change pending availability, regulatory approval, and market conditions. Additional information is available upon request